Introduction

The financial crisis of 2008, often referred to as the Global Financial Crisis (GFC), was a pivotal event that shook the global economy and precipitated widespread financial turmoil. This case study explores the causes, impacts, and lessons learned from the 2008 financial crisis, highlighting its far-reaching consequences on financial markets, economies, and regulatory frameworks worldwide.

Causes of the Financial Crisis

- Subprime Mortgage Market Collapse: The crisis was triggered by the collapse of the subprime mortgage market in the United States. Irresponsible lending practices, including issuing high-risk mortgage loans to borrowers with poor credit histories (subprime borrowers), led to a surge in defaults and foreclosures.

- Securitization and Mortgage-backed Securities (MBS): Financial institutions packaged subprime mortgages into complex financial products known as mortgage-backed securities (MBS) and collateralized debt obligations (CDOs). These securities were sold to investors globally, spreading risk throughout the financial system.

- Lax Regulatory Oversight: Regulatory failures and inadequate oversight allowed risky lending practices to proliferate unchecked. Deregulation of financial markets, including the repeal of the Glass-Steagall Act, contributed to excessive risk-taking and speculative behavior among financial institutions.

- Credit Rating Agencies: Credit rating agencies assigned inflated ratings to MBS and CDOs, misrepresenting their creditworthiness and exacerbating investor losses when the underlying mortgages defaulted.

- Global Interconnectedness: The interconnected nature of global financial markets amplified the contagion effects of the crisis. Financial institutions worldwide were exposed to toxic assets and faced liquidity shortages, leading to a credit crunch and systemic instability.

Impacts of the Financial Crisis

- Bank Failures and Bailouts: Major financial institutions, including Lehman Brothers, faced insolvency or bankruptcy. Governments intervened with massive bailouts and liquidity injections to stabilize financial markets and prevent further collapses.

- Economic Recession: The financial crisis precipitated a severe global recession, characterized by declining GDP growth, rising unemployment, and widespread business closures. Consumer confidence plummeted, leading to reduced spending and investment.

- Housing Market Collapse: The collapse of the housing market triggered a wave of foreclosures, declining property values, and loss of household wealth. Many homeowners found themselves underwater on their mortgages, owing more than their homes were worth.

- Financial Market Volatility: Stock markets experienced sharp declines and increased volatility. Investors faced significant losses as stock prices plummeted, exacerbating market uncertainty and investor anxiety.

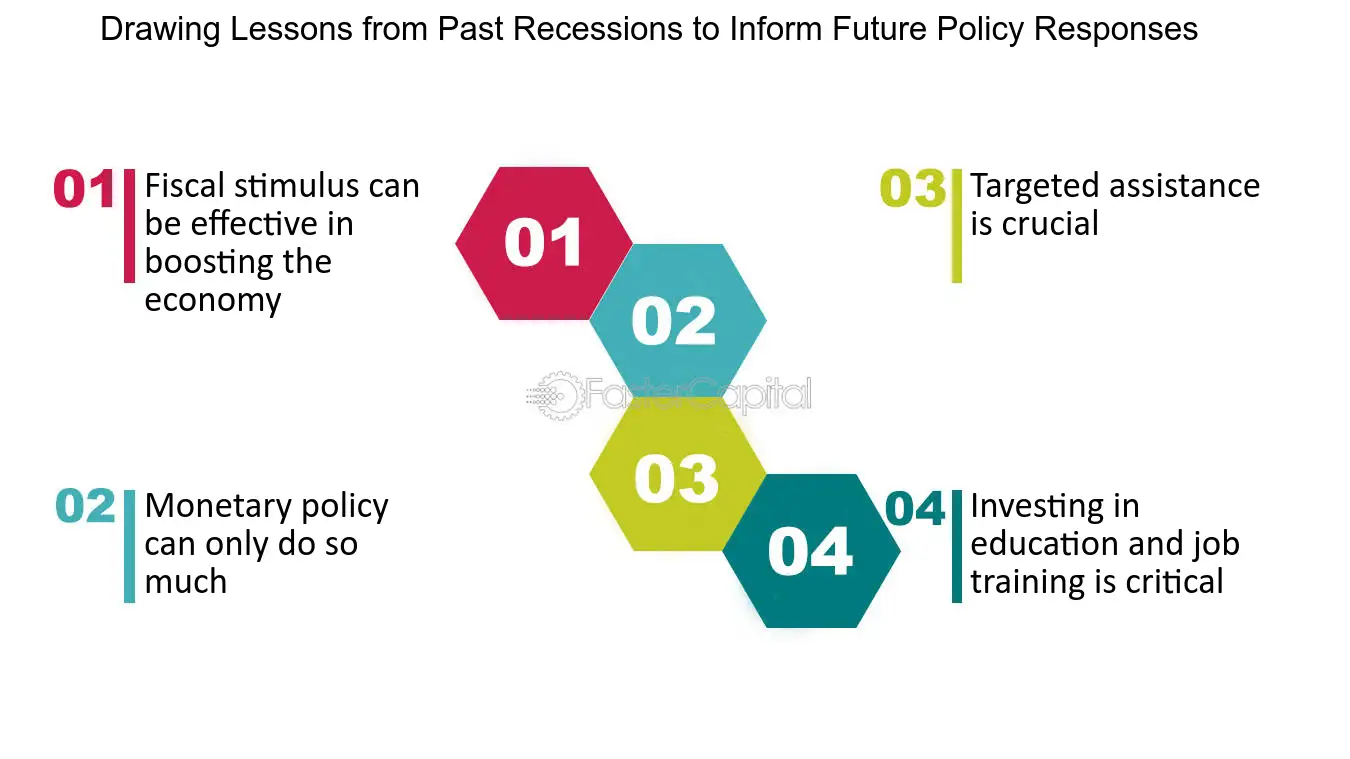

Policy Responses and Lessons Learned

- Government Intervention: Governments implemented unprecedented fiscal stimulus measures and monetary policies, including interest rate cuts and quantitative easing, to revive economic growth and stabilize financial markets.

- Financial Regulatory Reforms: The crisis prompted regulatory reforms aimed at strengthening oversight of financial institutions, enhancing transparency in financial markets, and curbing risky lending practices. The Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States was a notable legislative response.

- Risk Management and Corporate Governance: Financial institutions revised risk management practices and adopted stricter corporate governance standards to mitigate future financial vulnerabilities and improve accountability.

- Global Coordination: International cooperation and coordination among central banks and regulatory authorities were enhanced to address cross-border financial risks and promote financial stability globally.

Conclusion

The 2008 financial crisis serves as a stark reminder of the risks inherent in financial markets and the interconnectedness of the global economy. While significant reforms have been implemented to strengthen resilience and mitigate systemic risks, ongoing vigilance and adaptive policies are essential to safeguard against future crises.

Future Challenges

As global economies recover from the impacts of the COVID-19 pandemic, vulnerabilities such as high debt levels, geopolitical tensions, and emerging market risks underscore the importance of prudent risk management and sustainable economic policies in maintaining financial stability.

References

- Financial Stability Board (FSB)

- International Monetary Fund (IMF)

- Academic Research on Financial Crises